Personal debt To Money Proportion: Determining The Straight to Safer Home financing

People have some borrowing from the bank. Whenever applying for a mortgage, you need to know loans to help you earnings ratios to decide whether it’s likely to perception what you can do to secure a mortgage.

Every bank should determine if you have other pre-established costs, as well as how much to possess, therefore it is usually best if you check out so it before you make an app to make sure you never risk a rejection that spoil your credit rating.

For folks who still need to, you could potentially consult a beneficial callback immediately that works well to own your otherwise click on the button less than to obtain a competitive, secure financial bring.

What’s a loans in order to Earnings Proportion, and exactly why Will it Amount?

A debt to help you money proportion investigates exactly how much you prefer to invest each month on the bills, as compared to everything secure. The gains shape is gross, thus before fees and just about every other write-offs.

Essentially, it ratio reveals a lender just how much financial obligation you’re in, versus that which you earn to assess how risky your application was.

- Sound right your own monthly continual personal debt money.

- Make sense their monthly revenues and you may wages, also masters.

- Split the fresh costs of the earnings, after which proliferate of the 100 to obtain a percentage.

Once the a good example, if you spend debts off ?step one,000 30 days and secure ?dos,five-hundred, then your loans to help you earnings ratio try forty%.

$255 payday loans online same day Alaska

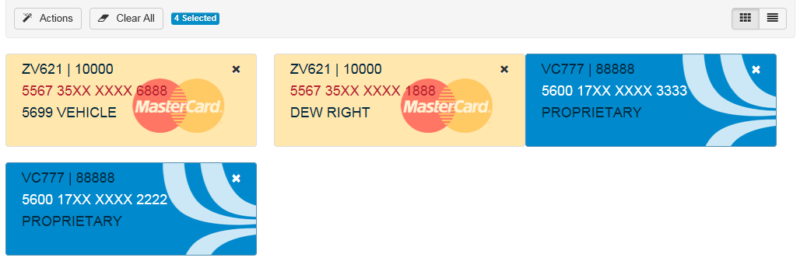

What Debts are part of home financing Loans so you can Money Proportion Computation?

- Fund and handmade cards.

- Education loan costs.

- Youngster service costs.

- Mortgage payments or rent.

- Vehicle money.

- Financial obligation Administration Package costs.

With debt doesn’t invariably suggest you will never be acknowledged for an excellent mortgage – and you may actually see remortgaging in an effort to consolidate almost every other bills and streamline your own outgoings.

The brand new perception will depend on what sort of loans you may have, exactly how large the newest repayments is actually, and you can exactly what your websites throwaway earnings turns out.

What Personal debt in order to Money Proportion is suitable having a mortgage Vendor?

The low brand new ratio, this new quicker financial obligation you have, and therefore the safer the job. A ratio of around 20% in order to 29% may be sensed reasonable exposure and will be offered most readily useful appeal pricing.

For those who have a premier obligations in order to earnings proportion of over 50%, it’s usually advisable to clear a few of that loans before applying having a mortgage, whilst would mean your costs you are cited often end up being faster competitive.

Since the a harsh idea, new below table reveals some examples of obligations to help you money percentages, and you can what which could imply for the mortgage application:

Truly the only selection in this circumstances might possibly be a home loan based upon to your other factors away from personal debt-to-money rates, based on most other cost data.

Essential are my Obligations in order to Money Proportion in enabling a beneficial Home loan?

Most Uk loan providers commonly trust obligations so you can earnings data in order to work out whether you can afford a home loan – however, not absolutely all loan providers will receive an equivalent procedures in place, otherwise cure an equivalent ratio in the same way.

Most of the time, the month-to-month financial can cost you need to be within this a specific commission of your earnings, and more than loan providers commonly cover the obligations so you’re able to earnings ratio and you will maybe not lend so you’re able to anyone more than one height.

Is actually Debt in order to Money exactly like my Credit score?

Zero, talking about a couple of something different. You may have a top personal debt to earnings ratio but a good good credit score, the lowest credit history, and you may the lowest debt to income ratio.

Borrowing referencing bureaus do not know just how much you earn which look at the borrowing overall performance and repayments record, recording one things.