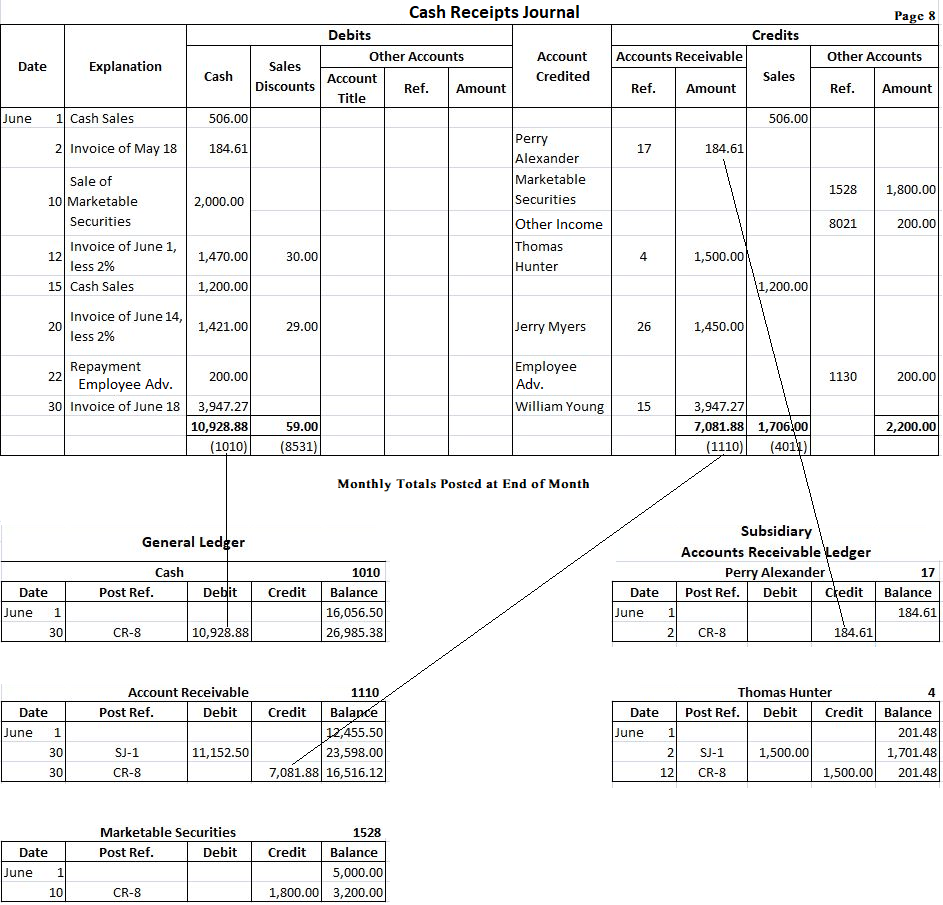

Here’s what the cost breakdown may look such as having an effective USDA Restricted recovery loan to have a $3 hundred,000 house or apartment with an effective $thirty five,000 reple assumes on your tools are turned-on in the period of the appraisal.

USDA Restricted analogy

Now let us have a look at a possible dysfunction to have a great USDA Simple renovation mortgage in which the debtor try accepted to have $250,000 that’s to shop for a home for $2 hundred,000.

In this example, we are going to assume this new tools aren’t switched on at the time of assessment, therefore, the backup amount is 15% of repair money.

USDA Practical analogy

A great USDA fixer-top loan supplies the same center benefit due to the fact an excellent USDA buy loan: 100% capital getting an individual-family home. However get the extra regarding financial http://www.availableloan.net/installment-loans-ne/columbus support 100% of the renovation can cost you as well. This means, you can purchase and you can upgrade with just one mortgage, most of the during the little money down.

In addition to, should your residence’s really worth just after renovations is over everything are obligated to pay on your mortgage, you really have immediate collateral in the assets.

- Your house have to be inside the a USDA-qualified outlying or residential district urban area

- You need to meet up with the money constraints on the city where you plan to shop for

- Credit history regarding 620 or higher (even though loan providers is able to accept your having a lower life expectancy score if you are if you don’t creditworthy)

- A qualifying loans-to-earnings ratio* influenced by USDA’s Secured Automatic Underwriting

Like with good USDA buy loan, USDA renovation money want an appraisal, and that the financial have a tendency to order when you go under bargain towards a home. You’ll also must find a contractor and discover a certified quote, otherwise a price like the scope away from functions and related can cost you, and gives that with the financial.

An instant notice towards USDA income restrictions: Lenders look at your home earnings without invited write-offs to choose the USDA qualification. In the event your revenue is apparently more than the limits for the town, you might still meet the requirements just after deductions was pulled.

That is why it certainly is smart to keep in touch with a great USDA financial in the place of speculating at the eligibility your self. If you aren’t USDA eligible, your own lender will show you and therefore almost every other financing applications could possibly get performs for your requirements.

There are a number of zero and low down fee financing solutions, along with your bank can help you find the correct you to.

To order an effective fixer-top which have a beneficial USDA mortgage: How it works

Many tips doing work in to acquire an effective fixer-upper with good USDA recovery financing resemble those individuals you might undergo having a great USDA purchase mortgage. But you can find accessories, specifically due to the fact recovery really works initiate.

Step 1: Get preapproved

This ought to be your first step regardless of the version of financial you desire to rating. The preapproval letter will tell you how much cash you could potentially borrow therefore the sorts of money your be eligible for. Even as we mentioned above, the limitation preapproval count is where much you might acquire complete, including the price and restoration will set you back.

Step 2: Build an offer on a property

Ensure that your agent knows that you intend so you can play with a beneficial USDA financing order your home. In that way they could assist you property which can be in the USDA-qualified elements just.

Step three: Select a company and you will schedule the new assessment

Immediately after the bring was acknowledged, your own financial will begin control the loan and you will need to get a specialist to submit a remodelling bid to the bank. You can’t perform the renovations oneself with a great USDA recovery loan, therefore begin looking forever contractors near you just as you decide on one of these finance.