- Closure on the Loan: Immediately following all of the called for certificates is met, new debtor can be go-ahead having closure towards FHA design loan. Into the closing process, all of the requisite financing files might be analyzed and you will finalized. At this point, the latest borrower are certain to get the income necessary to begin the construction or recovery process.

Converting so you can Long lasting Financial

Among benefits of an FHA framework financing is the ability to transfer it on the a long-term mortgage since the design is finished. So it eliminates dependence on a second closure and you can simplifies the fresh financial support process.

Following construction otherwise restoration is gone, the fresh new borrower will need to provide the bank having a certification out of occupancy or any other records confirming the culmination of one’s investment.

Since the assets seats the final examination, the latest FHA framework financing are turned into a permanent home loan. The latest terms of the mortgage tend to change on the small-name design financing towards enough time-name financial, together with borrower begins and make typical monthly obligations predicated on the new concurred-upon terms.

It is vital to note that this new methods and requirements may vary a bit depending on the lender and you will certain factors. Operating closely which have a skilled FHA-recognized lender regarding techniques can assist be sure a flaccid change out of build capital so you can a permanent financial.

FHA compared to. Antique Funds

With respect to money a construction investment, borrowers has actually several head options to envision: FHA (Government Housing Administration) fund and you can traditional fund. Each kind of loan has its own has and you may characteristics, that can change the borrower’s qualifications and you can financing terms.

FHA Mortgage Keeps

FHA money try supported by the fresh new Federal Casing Administration and tend to be given by FHA-accepted loan providers. These types of finance are easier to be eligible for than simply traditional funds and possess less down payment standards. Individuals that have a credit rating as low as 500 can be qualified to receive an FHA loan, even if a credit history of 580 or even more are better. Although not, it is essential to remember that FHA loans with all the way down credit ratings will come which have large yearly fee rates (APRs) than the fund which have highest credit ratings.

- Reduce percentage: FHA financing need the very least advance payment of 3.5% to possess consumers with a credit rating out of 580 or maybe more. Having individuals which have credit scores ranging from five hundred and you may 579, a downpayment of ten% will become necessary.

- Home loan insurance rates: FHA funds need consumers to blow financial insurance fees (MIPs) for at least 11 years, and you can potentially for the entire lifetime of the borrowed funds whether your mortgage balance isnt paid off within that point physical stature. Which insurance rates protects the lending company in case the debtor defaults for the the borrowed funds.

- Flexible degree standards: FHA funds have significantly more easy certification conditions compared to conventional loans, causing them to accessible to a wide listing of individuals. However, you can still find criteria positioned regarding loans-to-income proportion and you can houses expense ratio.

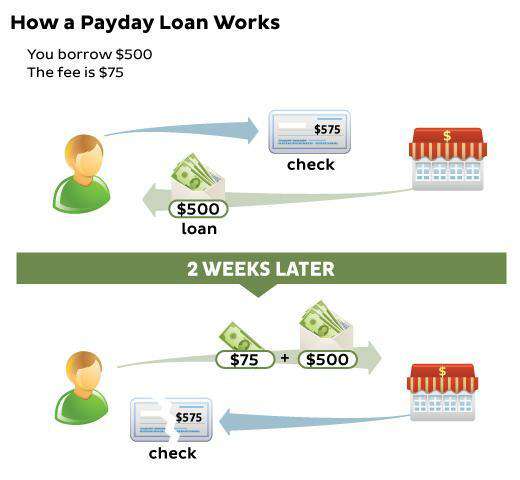

24 hour payday loans Houston AK

Old-fashioned Loan Functions

Antique finance, additionally, are not insured or guaranteed from the a national company like the FHA. These types of funds features more strict credit standards and generally speaking need large down money versus FHA financing. Private mortgage insurance policies (PMI) is needed if your debtor leaves off less than 20% of the residence’s worth. But not, borrowers have the option so you can request this new termination from PMI immediately following their loan harmony falls to 80% of one’s house’s new worthy of .

- Large downpayment: Old-fashioned money fundamentally need a down payment of at least 20% to end PMI. However, individuals that will afford a much bigger down payment can still like to get off 20% or more to prevent the extra price of mortgage insurance coverage.