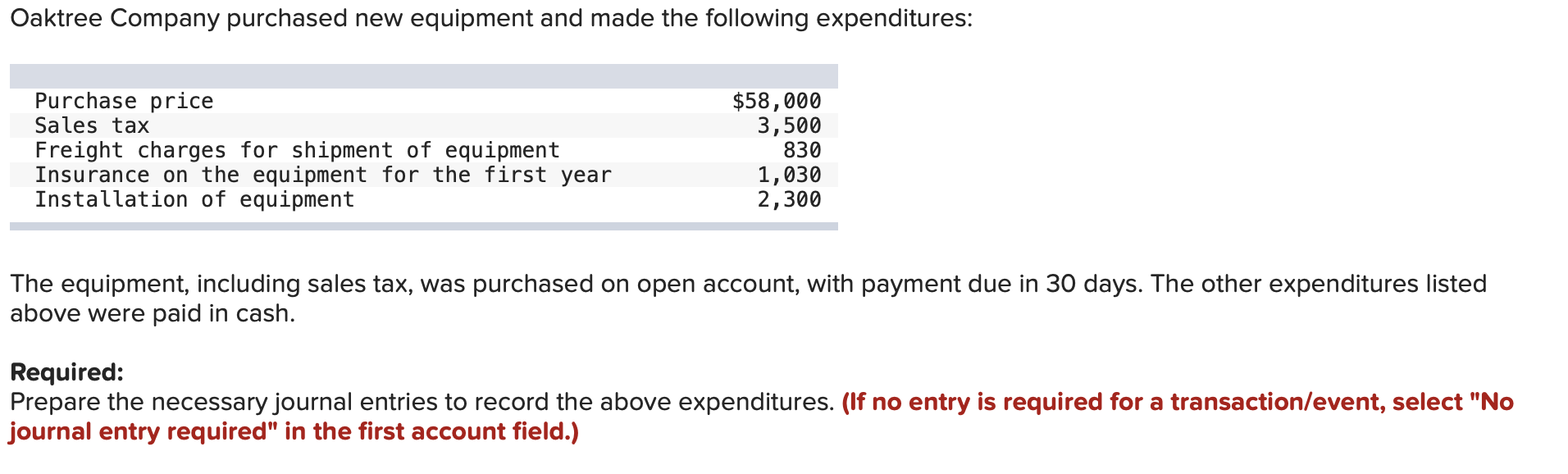

Thinking of the domestic but trapped since you don’t have Taxation Output (ITR)? You aren’t by yourself. Of several self-functioning someone and you can freelancers face it hurdle. But do not care, there are ways as much as it. In this blog, we will walk you through basic actions so you’re able to safer a home loan without ITR. We shall show relatable info and you can alternative methods to show your financial stability, working for you move closer to your ideal regarding homeownership.

What’s a keen ITR?

Taxation Get back (ITR) was a form that people and you can enterprises file into Earnings Income tax Institution from Asia so you can declaration its annual money, expenditures, or any other financial guidance. They info your income, write-offs, plus the taxes you’ve repaid inside monetary seasons. Submitting an enthusiastic ITR is an appropriate requirement for the individuals whose income is higher than a particular threshold.

- Proof Income: Loan providers use ITR to ensure your income. They suggests an extensive checklist of the earnings, which helps them assess what you can do to repay the loan.

- Economic Balance: Regular processing away from ITR means monetary abuse and you will stability. It reassures loan providers that you have a frequent revenue stream and you may manage your earnings really.

- Creditworthiness: ITRs offer a detailed financial history, permitting lenders look at your creditworthiness. A high money having regular ITR filings fundamentally usually means a beneficial high financing qualification.

- Amount borrowed Dedication: The total amount you might borrow can often be connected with your proclaimed income regarding the ITR. It can help loan providers determine the right loan amount centered on their repayment capacity.

Practical Tips about Securing a mortgage Rather than ITR

Securing a home loan rather than a taxation Return (ITR) can seem daunting, however it is not hopeless. Whether you’re notice-working, an excellent freelancer, or even in a situation where you haven’t filed the ITR, these practical tips helps you navigate the procedure and you can reach your perfect off homeownership.

step one. Care for good credit

A good credit score is one of the most crucial products from inside the securing a loan. Your credit score shows the creditworthiness and your power to pay-off lent money. To change your credit rating:

- Pay bills timely: Punctual percentage regarding bills, also playing cards and you will tools, accelerates your rating.

- Reduce The Expenses: Keep personal debt account reasonable if you are paying from current finance and you may bank card balance.

- End The fresh new Personal debt: You should never submit an application for unnecessary the fresh new personal lines of credit as it can adversely perception their score.

Think about your credit rating as your financial reputation. Just like you wouldn’t need a bad reputation at work or certainly one of members of the family, good credit assists create faith having lenders.

2. Reveal Choice Income Research

When you don’t have a keen ITR, presenting option evidences cash is vital. Listed below are some records you should use:

- Lender Statements: Show typical places you to mirror your income.

- Paycheck Glides: Give the last six months’ salary slides if you’re salaried.

step three. Offer a higher Down payment

Using a bigger downpayment decreases the amount you need to use. This is going to make you less risky on attention regarding loan providers. As much as possible manage, try to establish 20-30% of your own property’s well worth. This shows their partnership and you will decreases the amount borrowed, making it simpler with the bank so you’re able to accept your loan.

Imagine you are lending currency to a pal. If they promote 3k loan no credit check West Cornwall CT to cover a significant part of your pricing upfront, you’d getting well informed regarding having your money back, best? It functions the same exact way having loan providers.

4. Choose less Loan amount

Asking for a smaller sized loan amount is also significantly improve your possibility of recognition. Loan providers much more comfy lending small amounts while they perspective quicker exposure. Examine your position very carefully and try to obtain just everything you really need.

Consider it given that borrowing from the bank from a friend: asking for a smaller sized share causes it to be more likely they say sure.

5. Look after a steady Job

Loan providers choose individuals that have a reliable a career records. If you were with the same manager for many years, they suggests accuracy and you can monetary balances. Preferably, prevent switching work appear to before you apply for a loan.

Feel during the a position is like indicating a history of are dependable. Loan providers want to see that you are not just able to earn money, however, that you can do very consistently through the years.

6. Score an effective Co-Applicant

Having an effective co-applicant, especially you to with a decent credit rating and you may stable money, can enhance your application for the loan. This reduces the exposure to the lender given that there is certainly another person accountable for repaying the loan.

Consider a co-candidate since with a friend attest to you. It includes most guarantee towards the bank your mortgage tend to end up being paid.

seven. Approach NBFCs and Quicker Banking companies

Non-Banking Financial Businesses (NBFCs) and you will shorter banking companies often have so much more flexible criteria than just huge financial institutions. They are alot more willing to consider carefully your app actually instead an ITR.

8. Envision financing Facing Assets

For folks who own yet another property, thought financing facing possessions (LAP). This type of loan spends your house just like the guarantee, making it simpler to find acknowledged in the place of an ITR. The lender has got the promise of the home, and this minimizes its exposure.

Its such asking for financing with one thing worthwhile so you can pawn. The financial institution understands he’s got something to slip right back towards the if anything make a mistake.

The right path so you can Homeownership Initiate Right here

Because of the maintaining a good credit score, providing choice money evidences, and you may provided less loan providers or NBFCs, you can notably improve your possibility of securing home financing versus ITR. Consider, each step you’re taking brings your closer to purchasing your dream household.

When you’re willing to grab the next step inside the protecting the financial, assist Borrowing from the bank Dharma assist you through the process. With this expert advice and you will designed options, i result in the road to homeownership convenient and a lot more attainable.

Faq’s

Yes, you could. Loan providers could possibly get think alternative money proofs such as bank statements, Mode sixteen, and you can providers financials to evaluate your loan eligibility.

Records such as for example lender statements, salary glides, Means 16, a job characters, and audited economic statements can be utilized as the substitutes getting ITR.

Yes, some Non-Financial Economic Businesses (NBFCs) and less banks be much more flexible due to their documentation requirements and you may may offer lenders in place of ITR.

Increased down payment reduces the amount borrowed expected, causing you to a diminished chance to possess loan providers, and so increasing your odds of acceptance.

Freelancers also have bank statements exhibiting normal deposits, bills, deals, otherwise a keen audited membership of their earnings to show its income stability.